05212021 :: Friday finance

A partial digest:

The crypto market imploded, then imploded again in spectacular fashion. At one point, more than $1 trillion market cap had vaporized. The hits just kept on coming. If buying the dips, extreme caution is advised.

The space is facing multiple headwinds, including the investigation of the Binance exchange (one of the largest); what the IRS and Treasury want; concerns with the Tether stablecoin’s reserves; China’s unforgiving stance on crypto; good old-fashioned forced liquidations of highly leveraged positions; and Elon Musk’s market manipulating statements. The latter party may draw some regulatory scrutiny, himself.

A very clear issue that will remain and support market volatility until it is addressed is that there is very little in the way of formally established regulation of the crypto space globally, as of yet.

Quick wrap:

Infrastructure spending in the US is already on the chopping block.

Index volatility in the US has thus far led to more flatlining for the month of May, in particular. As stated here before, diversified dividend plays can make for a healthier portfolio in such times.

Yields finished slightly down after a volatile week.

Source: Trading Economics. The DXY breached 90.

Oil finished slightly down.

CALL: No change; near to semi-intermediate term, prices could rise further given supply shocks, OPEC+ micromanagement, inflation expectations, "recovery," and more fiscal spending, among other things. Longer term, it's a dying industry.[tracking: XLE, GGN]The S&P Global Clean Energy index finished up for the week.

[tracking: TAN]Gold jumped to finish above $1,880. We’re still not that close to the high reached in August of 2020.

CALL: In the very near term, it must be acknowledged that gold has the uncertain potential to rise further as traders who call the competence of the Fed and US Treasury into question drive prices higher. Beyond the very near term, however, no change; the expectation remains for ever-lower valuations moving forward. Looking for an eventual floor around $1,200/oz.[tracking: JDST, GDX, GLD, SLV, ZSL]Commodities finished mixed to down for the week.

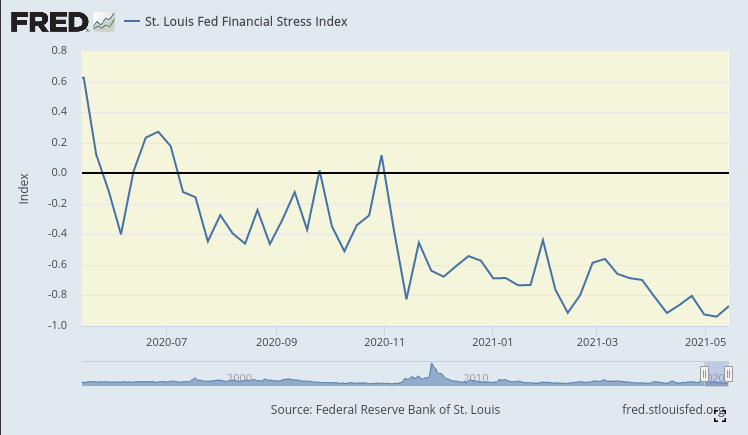

The St. Louis Fed Financial Stress Index (STLFSI2) for the week ending May 20 ticked up to -0.8694 from -0.9396 the week prior. It remains well below zero, or the stress the economy experiences under “normal financial market conditions.”

Total crypto market cap was 1.37 trillion as of publication, meaning outflows of roughly $890 billion since last reading.

Flows for the week ending May 19, per Refinitiv Lipper data:1

Global money market funds witnessed inflows of $7.94 billion.

Global inflation protected bonds saw inflows of $1.92 billion, while junk bonds realized outflows of $2.69 billion.

Global equities saw decreased inflows of $5.1 billion.

US money markets saw inflows of $25.34 billion, a 4x jump.

US bond funds realized inflows of $2.83 billion.

US equities saw outflows of $5.43 billion, with selling especially hitting growth stocks and the tech sector. Note that money continued to flow into financial equities, however. Financial companies in the US stand to benefit from higher future rates while restrictions against their buybacks and dividend payouts are set to be lifted come the end of June.

US inflation protected bonds witnessed inflows of $1.37 billion.

Japanese stocks witnessed outflows of $10.22 billion for the week ending May 14.

Chinese equities saw outflows of $1.83 billion.

Emerging market stocks realized outflows of $879 million, with EM bonds not far behind at $878 million in outflows.

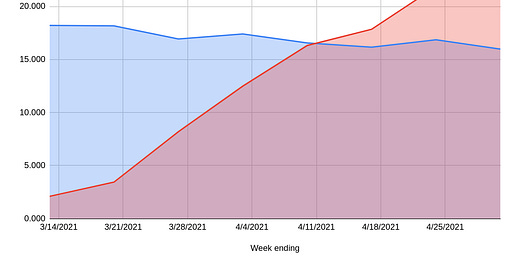

Initial jobless claims in the US for the week ending May 15 declined to 444k (SA) from an upwardly revised 478k for the week prior. One year ago, we saw 2.149 million. We are now in the one year ago timeframe where the US has been square in the grips of the pandemic. The four week moving average decreased to under 505k.

To add to this, just over 95k on an unadjusted basis applied for PUA, down from the previous week’s upwardly revised number of sub 104k.

As of May 1, close to 16 million people (UA) were still claiming unemployment benefits of some kind, up almost 700k from the week prior. In the comparable week one year ago, the US witnessed nearly 21 million people claiming unemployment insurance from all programs together.

The Extended UI benefits program saw the biggest increase of nearly 23.6k from the previous week.

These numbers are still cause for concern, although we have now dropped and remained below last year’s number of total continued claims for the comparable week.

Mortgage applications rose a blended 1.2% (SA) for the week ending May 14, due to an increase of 4% in refis overshadowing a decrease of 4% in homebuyer applications. ARM activity rose slightly to 3.9% of all applications from 3.8% the week prior.

The release finally mentioned the average loan size across all purchase applications again: $411,400. MBA’s choice for a 30Y fixed benchmark rose several basis points to 3.15%. The simple national average as reported by Freddie Mac (via FRED) for May 20 rose to 3.00% on the 30Y fixed, up six basis points from that reported last week.

At the same time, the forbearance rate as of May 9 fell to 4.22% as more households made their exit in one way or another. Exits, the good, the bad, and the ugly, picked up again as we marked roughly 14 months of being beset by the pandemic in the US.

The share of households that missed payments and exited with no loss mitigation plan in place increased, as did the portion exiting with loan deferrals or partial claims and the segment extending mortgage forbearance. At the same time, the group that continues to make their monthly payments during their forbearance period fell.

MBA estimates that 2.1 million households remain in a state of mortgage forbearance.

The housing market is getting further mangled by the global health crisis, materials shortages, falling housing starts, impoverished renters, and extreme investor appetite for properties, among other things. The latter group especially is seeking to keep Americans renting, not buying, their own homes. With access to cheap capital and direct pipelines to existing and future properties that never see the open market, there may be an unfair advantage crystallizing.

CALL: On hold. The trend of megalandlords increasingly making Americans perpetual renters rather than owners of property complicates the housing market picture. That said, Bloomberg is joining the chorus of voices that believe that the housing market may be in for acoolingfor various reasons, not the least of which are costs.[tracking: DRV, XLRE, SPG, VNO, WPG, NLY]Used car trends: The latest Carvana car count as of May 21 rose 14.75% to 43,847 vehicles from 38,210 the week prior. The four-week moving average came in at 39,269. Meanwhile, the CarGurus average price index continued rising, this time by 1.45% to $25,650 from $25,283. This is a new high for the index since said data collection began for this newsletter in November of last year.

Sovereign matters:

India COVID-19 fatalities keep climbing in a sickening spike, while Thailand goes into a state of emergency.

S&P Global downgraded Colombia. One obstacle the country is facing is the political difficulty around passing tax reform.

Moody’s downgraded Ethiopia citing the rising possibility of creditor losses as the country has made little progress in overhauling its existing debt.

Taiwan thinks vaccine aid from the US can help with the global chip shortage, another sign that as we do not get the global health crisis under control, the global economy suffers.

Pakistan will be issuing its first green bond ever to finance the development of hydropower.

Jitters over China’s bad loans bank, Huarong, continue.

[tracking: EDC]The current state of equity: The Bank of Canada admits QE may widen wealth inequality.

During the pandemic alone, the US has now witnessed 221,708 fatalities strictly classified as “pneumonia” with no attribution to COVID-19 on the death certificates, per CDC excess deaths data. This equates to an average of 436 people per day since the start of 2020. As the CDC points out, many of these could be miscategorized COVID-19 fatalities going unrecognized in official tallies, meaning we’re undercounting. This, in addition to the official coronavirus death toll of 594,188, puts the probable COVID-19 death figure somewhere north of 710k.

Across all causes of death, we suffered 119% of the deaths in 2020 that we would have expected in non-pandemic times given historical trends. Along with other situations where COVID-19 was not designated as a cause of death but where SARS-CoV-2 likely triggered a condition or exacerbated a preexisting one—heart disease, hypertension, diabetes, dementia—the “real” fatality count is probably much higher.2

When the average of “pneumonia” deaths per day begins to decline significantly and consistently, perhaps we'll be able to start saying that we might be gaining the upper hand on SARS-CoV-2. We’re not there yet.

NPR reported as of Friday that 38.1% of the population was fully vaccinated. That puts the vaccination rate at roughly 2%/week, down from last week's 3.4%/week.

Public Health England is reporting that the Pfizer-BioNTech vaccine is 88% effective against symptomatic illness from India’s B.1.617.2 variant (there is more than one variant of the B.1.617 mutation).

If accurate, this is positive news. It may do nothing to overcome vaccine hesitancy in the US, though, leaving the majority of the population in the US open to further infections, and possible hospitalizations and fatalities, from multiple variants. Indeed, the India variant is already in the US.

Additionally, many countries are still struggling to get their hands on any vaccines at all. We are a world of global supply chains. How long will they remain broken for because too many continue to get sick?

Footnotes

Valenta, Philip. “Death by COVID-19 Hides in Plain Sight.” HedgeHound (June 29, 2020). The research includes the methodology behind the figures presented here every week, as well as information on historical pneumonia trends and death categorization in the US during the global pandemic. It was last updated on December 4, 2020.