05142021 :: Friday finance

A partial digest:

There is a simple factor contributing majorly to the steep inflation number of 4.2% for the 12 months (UA) ending April 2021; oil prices were negative one year ago April, and the industry was cratering. The energy category, along with its subcategories, had the highest numbers in the BLS’s latest report. Gasoline alone for the 12 months ending April 2021 saw a nearly 50% rise.

The Fed and others should know this; and the jump in official inflation figures will prove fleeting.

By May 2020, crude oil was recovering, though gasoline took longer. This should make for milder inflation numbers moving forward.

Elsewhere, US retail and food service sales for April were lackluster; they essentially did not change from the previous month. This lends credence to the possibility that there is no consumer spending binge incoming, but also that there is no driver in this arena for systemic inflation.

People are still struggling without additional stimulus. Now, they are also in danger of losing supplemental federal UI benefits as certain state governors sever their states’ ties to the programs in a bid to forcibly coerce laborers back into the workforce for employers who do not wish to engage in market competitive behavior like raising wages. A recent report indicates that some $100 billion in UI benefits for over 16 million workers is at stake.

Quick wrap:

Yields rose to finish at 1.6352 on the 10Y, though they were well off their highs earlier in the week.

The DXY finished slightly up for the week, though off its highs earlier in the week.

Oil finished roughly flat for the week, though crude stocks in the US fell.

CALL: No change; near to semi-intermediate term, prices could rise further given supply shocks, OPEC+ micromanagement, inflation expectations, "recovery," and more fiscal spending, among other things. Longer term, it's a dying industry.[tracking: XLE, GGN]The S&P Global Clean Energy index again finished down for the week.

[tracking: TAN]In a volatile week, gold finished slightly up again, this time above $1,840.

CALL: In the very near term, it must be acknowledged that gold has the uncertain potential to rise further as traders who call the competence of the Fed and US Treasury into question drive prices higher. Beyond the very near term, however, no change; the expectation remains for ever-lower valuations moving forward. Looking for an eventual floor around $1,200/oz.[tracking: JDST, GDX, GLD, SLV, ZSL]Overall, commodities were mostly down for the week.

The St. Louis Fed Financial Stress Index (STLFSI2) ticked down to -0.9396 from -0.9257 for the week ending May 13. It remains well below zero, or the stress the economy experiences under “normal financial market conditions.”

Total crypto market cap was 2.26+ trillion as of Friday, meaning outflows of approximately $90 billion since last reading. There is little doubt that what scared stock investors off repeated itself in the crypto space, though there were other issues as well. Some cryptos, such as ADA, continued to outperform, however. Filings in the state of Delaware indicate that Grayscale, the largest cryptoasset trust provider in the space, will be offering a new ADA fund, among others. This may be driving price action in certain alt-coins. In related news, VanEck is trying to be first to offer an ETH ETF.

Flows for the week ending May 12, per Refinitiv Lipper data:

Global equities saw increased inflows of $15.1 billion. Financial sector funds saw inflows of $1.3 billion. The tech sector saw outflows $1.2 billion.

Global Bond inflows fell to $11.2 billion.

US equities saw inflows of $6.91 billion, with a large portion of it going to cyclicals.

US bonds saw inflows of $4.51 billion, with a fair amount of that predictably going to inflation protected securities.

US money markets saw inflows of $5.23 billion.

Emerging market equities saw larger inflows of $429 million. Meanwhile, EM bonds saw a jump in inflows of $1.06 billion.

Precious metals saw inflows of $305 million.

Initial jobless claims in the US for the week ending May 8 declined to 473k (SA) from an upwardly revised 507k for the week prior. One year ago, we saw 2.315 million. We are now in the one year ago timeframe where the US has been square in the grips of the pandemic. The four week moving average decreased to 534k.

To add to this, over 103k on an unadjusted basis applied for PUA, up from the previous week’s upwardly revised number of close to 102k.

As of April 24, over 16.855+ million people (UA) were still claiming unemployment benefits of some kind, up almost 700k from the week prior. In the comparable week one year ago, the US witnessed more than 21.863 million people claiming unemployment insurance from all programs together.

The PUA UI benefits program saw the biggest increase of over 420k from the previous week.

These numbers are still cause for concern, though we have now dropped and remain below last year’s number of total continued claims for the comparable week.

Job openings in the US increased to their highest level since record keeping began at the end of 2000, or 8.1 million openings, and some governors are doing their damnedest to manipulate their residents into those positions, never mind vaccinations, masks, workplace safety, wages, or anything else; all for the sake of the owners of capital and the politicians’ relationships with them.

Mortgage applications rose a blended 2.1% (SA) for the week ending May 7, due to an increase of 3% in refis and 1% in homebuyer applications. ARM activity fell slightly to 3.8% of all applications from 3.9% the week prior.

The release once again neglected to mention the average loan size across purchase applications. MBA’s choice for a 30Y fixed benchmark fell several basis points to 3.11%. The simple national average as reported by Freddie Mac (via FRED) for May 13 declined to 2.94% on the 30Y fixed, down two basis points from that reported last week.

New home purchase applications alone for the month of April increased 30.8%. This was a decline from March levels.

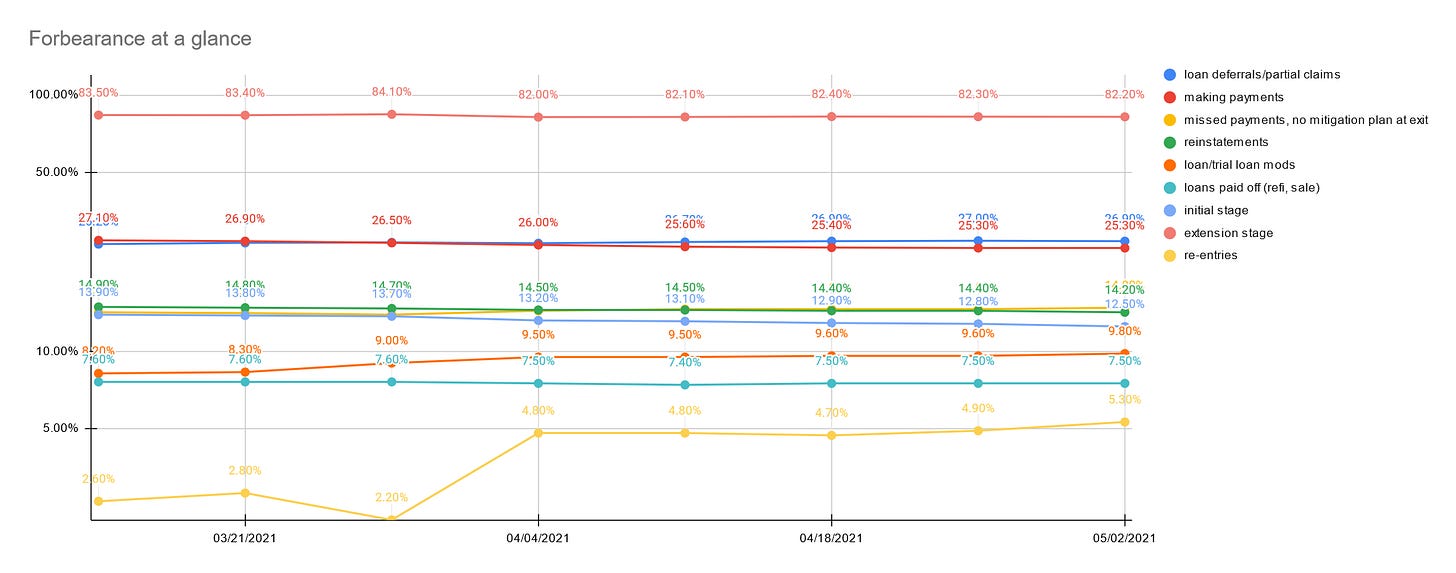

At the same time, the forbearance rate as of May 2 fell to 4.36% as more households made their exit in one way or another. Exits, the good, the bad, and the ugly, picked up again as we marked roughly 14 months of being beset by the pandemic in the US.

The share of households that missed payments and exited with no loss mitigation plan in place increased, as did the portion exiting with loan/trial loan modifications and the segment re-entering mortgage forbearance. At the same time, the group that continues to make their monthly payments during their forbearance period was flat, while the share of household exits that resulted in reinstatements shrank.

MBA estimates that 2.2 million households remain in a state of mortgage forbearance.

CALL: No change; housing weakness inbound. For the call to reverse, labor conditions would have to consistently improve, among other things.[tracking: DRV, XLRE, SPG, VNO, WPG, NLY]Used car trends: The latest Carvana car count as of May 14 rose 2.48% to 38,210 vehicles from 37,285 the week prior. The four-week moving average came in at 36,870. Meanwhile, the CarGurus average price index continued rising, this time by 1.65% to $25,283 from $24,873. This is a new high for the index since said data collection began for this newsletter in November of last year.

Sovereign matters:

India continues to reel from the onslaught of SARS-CoV-2. Bodies are being discovered in rivers, though it is not entirely clear if the dumping is only of persons deceased from COVID-19.

The Paris Club is ready to put a $2.4 billion debt payment from Argentina on hold should certain conditions be met. This may help the country avoid yet another default, which would be its tenth of the overseas type.

Global tourism projections for 2021 remain bleak for many nations.

The current state of equity: A genuine recovery depends on women returning to the workforce.

During the pandemic alone, the US has now witnessed 218,787 fatalities strictly classified as “pneumonia” with no acknowledgement of COVID-19 on the death certificates, per CDC excess deaths data. This equates to an average of 437 people per day since the start of 2020. As the CDC points out, many of these could be miscategorized COVID-19 fatalities going unrecognized in official tallies, meaning we’re undercounting. This, in addition to the official coronavirus death toll of 584,725, puts the probable COVID-19 death figure somewhere north of 700k.

Across all causes of death, we suffered 119% of the deaths in 2020 that we would have expected in non-pandemic times given historical trends. Along with other situations where COVID-19 was not designated as a cause of death but where SARS-CoV-2 likely triggered a condition or exacerbated a preexisting one—heart disease, hypertension, diabetes, dementia—the “real” fatality count is probably much higher.1

When the average of “pneumonia” deaths per day begins to decline significantly and consistently, perhaps we'll be able to start saying that we might be gaining the upper hand on SARS-CoV-2. We’re not there yet.

NPR reported as of Friday that 36.2% of the population was fully vaccinated. That puts the vaccination rate at 3.4%/week, up from last week's 2.8%/week.

With vaccinations came updated guidance from the CDC on mask wearing, which in turn is being condemned by National Nurses United, the largest union of registered nurses in the US. Major American retailers are following the CDC’s lead. But, what about those breakthrough infections, or the India variant, among other things?

The WHO says India variant B.1.617 calls the efficacy of existing vaccines into question, while the chief of the NIS says of the vaccines that “it looks like it ought to be good enough to make Americans protected.” How convincing. Only time will tell. BioNTech, for one, is investing further for the future.

Footnotes

Valenta, Philip. “Death by COVID-19 Hides in Plain Sight.” HedgeHound (June 29, 2020). The research includes the methodology behind the figures presented here every week, as well as information on historical pneumonia trends and death categorization in the US during the global pandemic. It was last updated on December 4, 2020.