05072021 :: Friday finance

A partial digest:

The current US administration is entering a predicament phase, facing the conundrum of seeking to spend more without the comfort of knowing that it can easily borrow more to do so. Apparently Treasury has been doing things in a certain way to avoid hitting the debt ceiling, but it’s capacity to do that may be coming to an end in the summer timeframe, says Yellen.

Earlier in the week, Yellen walked back remarks about an impending recovery and rates rising accordingly. For their part, PIMCO and Goldman Sachs think the recovery and inflation, or reflation, trade, and any subsequent raising of rates by the Fed, is overblown. Rather, the Fed is likely to stay the current course for a while.

What’s happening in India is emanating to neighboring nations like Sri Lanka, Nepal, and Indonesia. Bangladesh and South Africa count among the nations that have just now detected the India variant, B.1.617, inside of their borders. The possibility exists that, as before, the wave spreads further and engulfs nations everywhere, including the US, once again. India is, after all, the second most populous country in the entire world, and its peoples have dealings everywhere. Things don’t have to go any differently than how the pandemic began.

Variant B.1.617 is believed to be more transmissible and possibly more virulent. There is also a chance that it evades the protection of current vaccines. As it continues to spread within India and elsewhere, more mutations are in the cards, mutations which themselves can make for additional variants of interest and, ultimately, concern. This, right as we are letting our guard down in the US.

Economically speaking, supply shocks continue and may yet be exacerbated by what a global health crisis can do to the supply chain and, specifically, the labor force of production-level enterprises. The domestic example of lumber is telling: there is plenty of timber; it’s the finished lumber that’s hard to come by. Or, the case of chips, a shortage that isn’t due to a scarcity of silicon, but rather a scarcity of the finished product, the assembled semiconductors themselves. Production cannot keep up with demand with a labor force impacted by a health crisis.

Could there be enough supply shocks to add up to systemic inflation? Perhaps. For one, that’s only if consumers could no longer substitute goods. It would be the kind of system inflation that lasts as long as the global health crisis lasts, a health crisis that depends in part on billions of individuals making decisions for themselves that add up to cohesive action against SARS-CoV-2. We may have years ahead of us, at this rate.

Higher wages could make a difference in that they could convince individuals to take more risks in providing their labor, but South Carolina’s governor, for one, is trying a different method: good old-fashioned coercion. And it’s not just one politician; there’s a battle royale shaping up over UI benefits programs and fiscal support, more generally.

Even the US Chamber of Commerce, never mind the GOP, is in on the argument that UI benefits programs and fiscal spending more broadly are keeping people from returning to work. Biden dismisses the claim, and the latest jobs report actually reveals that the labor force participation rate increased, signifying more people went looking for work that they apparently could not find. And yet, the April miss was still huge.

But, this is really about the fight over wages and labor accommodations between pro- and anti-labor forces. If American companies would be more competitive in worker acquisition, i.e. pay more to fill positions, they might succeed in encouraging additional people to take the additional risks involved and put up with the additional hardship of working various jobs, especially menial ones, during a global health crisis, all while there is a simultaneous childcare crisis among other issues. That’s one of the last things companies wish to do, however.

We need look no further than Walmart fighting a federal $15 minimum wage proposal tooth and nail.

The current political administration is attempting to take care of its people during a once in a century black swan event, and conservative politicians and owners of capital are railing against it, though they can afford not to; they can afford higher wages. In the interest of getting more assistance out the door, Biden has already begun to hint at a willingness to compromise over the higher corporate tax rate proposed.

Not that it’s advisable to just get everyone back to work. It never was, as opposed to precautionary living funded by government support. But there are the idealized behaviors and outcomes some may insist upon beyond hope, and then there is reality.

Now, the chance that markets are going to get sideswiped again the way they did last year is growing, especially as leveraged and brazen as their participants are. It remains to be seen that booster shots and partially vaccinated populations can save us from ourselves.

Quick wrap:

Yields fell to finish near 1.58 on the 10Y.

The DXY finished down over devaluation concerns due to further economically accommodative policy measures in the US.

Oil finished up for the week, though off its highs.

CALL: No change; near to semi-intermediate term, prices could rise further given supply shocks, OPEC+ micromanagement, inflation expectations, "recovery," and more fiscal spending, among other things. Longer term, it's a dying industry.[tracking: XLE, GGN]

The S&P Global Clean Energy index again finished down for the week.

[tracking: TAN]

Gold rallied hard for the week, finishing above $1,800 for the first time in a couple of months.

CALL: In the very near term, it must be acknowledged that gold has the uncertain potential to rise further as traders who call the competence of the Fed and US Treasury into question drive prices higher. Beyond the very near term, however, no change; the expectation remains for ever-lower valuations moving forward. Looking for an eventual floor around $1,200/oz.[tracking: JDST, GDX, GLD, SLV, ZSL]Commodities of various stripes were mostly up for the week.

The St. Louis Fed Financial Stress Index (STLFSI2) ticked down to -0.9257 from -0.8052 for the week ending April 30. It remains well below zero, or the stress the economy experiences under “normal financial market conditions.”

However, the Fed revealed in its latest financial stability report that it is concerned about the amount of risk-taking that is occurring in asset markets. The danger of a reversal of fortune is real given the headwinds, especially when the investment community gets too comfortable.

Total crypto market cap as of Friday was nearing $2.35 trillion, up from $2.18 trillion the week prior, meaning inflows of approximately $170 billion since last reading.

Flows for the week ending May 5, per Refinitiv Lipper data:

Global money markets saw outflows of $21.6 billion.

Global equities saw inflows of $12.9 billion. Financial sector funds saw inflows of $1.94 billion. Keep in mind that in the US, the end of June marks a return to no buyback or dividend restrictions for banks.

Global Bond inflows rose to $17.16 billion.

US equities saw outflows of $22.1 billion.

European equities saw inflows of $11.1 billion.

Emerging market equities saw inflows of just $17 million. Meanwhile, EM bonds saw outflows of $268 million.

Precious metals saw outflows of $46 million.

Initial jobless claims in the US for the week ending May 1 declined to 498k (SA) from an upwardly revised 590k for the week prior. One year ago, we saw 2.784 million. We are now in the one year ago timeframe where the US has been square in the grips of the pandemic. The four week moving average decreased to 560k.

To add to this, over 101k on an unadjusted basis applied for PUA, down from the previous week’s downwardly revised 121k+.

As of April 17, over 16.157 million people (UA) were still claiming unemployment benefits of some kind, down over 404k from the week prior. In the comparable week one year ago, the US witnessed more than 17.847 million people claiming unemployment insurance from all programs together.

Almost all programs saw declines in continued claims for the week in question from the week prior.

These numbers are still cause for concern, though we have now dropped below last year’s number of total continued claims for the comparable week.

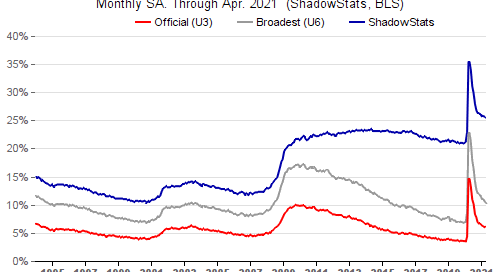

At the same time, the US jobs report fell flat on its face. The economy added a mere 266k jobs for the month of April, while the unemployment rate rose to 6.1% from 6.0%, with the ShadowStats alternate unemployment figure at 25.5%. For those identifying as Black, the unemployment rate climbed to 9.7%.

Of the different sectors, leisure and hospitality saw the biggest gains in nonfarm payroll employment.

Mortgage applications fell a blended 0.9% (SA) for the week ending April 30, due to an increase of 0.1% in refis being outweighed by a decrease of 3% in homebuyer applications. ARM activity jumped to 3.9% of all applications from 3.5% the week prior.

The release once again neglected to mention the average loan size across purchase applications. MBA’s choice for a 30Y fixed benchmark ticked up slightly to 3.18%. The simple national average as reported by Freddie Mac (via FRED) for May 6 declined to 2.96% on the 30Y fixed, down two basis points from that reported last week.

At the same time, the forbearance rate as of April 25 fell ever so slightly to 4.47%, with seemingly fewer households making their exit in one way or another. Exits, the good, the bad, and the ugly, were picking up as we marked roughly 14 months of being beset by the pandemic in the US, until recently.

Loan deferrals and partial claims increased, as did the share of people re-entering mortgage forbearance. Finally, the group that continues to make their monthly payments during their forbearance period shrunk again.

MBA estimates that 2.23 million households remain in a state of mortgage forbearance.

CALL: No change; housing weakness inbound. For the call to reverse, labor conditions would have to consistently improve, among other things. The latest jobs report was a disappointment.[tracking: DRV, XLRE, SPG, VNO, WPG, NLY]Used car trends: The latest Carvana car count as of May 7 decreased 1.19% to 37,285 vehicles from 37,735 the week prior. The four-week moving average came in at 35,295. Meanwhile, the CarGurus average price index continued rising, this time by 1.78% to $24,873 from $24,438. This is a new high for the index since said data collection began for this newsletter in November of last year.

Sovereign matters:

India’s coronavirus horror story is escalating. As of Friday, they had broken the record yet again for most new cases in a single day with 414,188. Sadly, their fatalities are climbing significantly, as well.

Sudan persists in pursuing at least $50 billion in debt relief.

Some traders are going short eurozone junk bonds.

[tracking: EDC]

The current state of equity: The “she-cession” landscape.

During the pandemic alone, the US has witnessed 216,058 fatalities strictly classified as “pneumonia” with no acknowledgement of COVID-19 on the death certificates, per CDC excess deaths data. This equates to an average of 438 people per day since the start of 2020. As the CDC points out, many of these could be miscategorized COVID-19 fatalities going unrecognized in official tallies, meaning we’re undercounting. This, in addition to the official coronavirus death toll of 581,056, puts the probable COVID-19 death figure somewhere north of 695k.

Across all causes of death, we suffered 119% of the deaths in 2020 that we would have expected in non-pandemic times given historical trends. Along with other situations where COVID-19 was not designated as a cause of death but where SARS-CoV-2 likely triggered a condition or exacerbated a preexisting one—heart disease, hypertension, diabetes, dementia—the “real” fatality count is probably much higher.1

When the average of “pneumonia” deaths per day begins to decline significantly and consistently, perhaps we'll be able to start saying that we might be gaining the upper hand on SARS-CoV-2. We’re not there yet.

NPR reported that 32.8% of the population in the US had been fully vaccinated as of Friday, up from 30% last week. That puts the vaccination rate at 2.8% for the week. This is still far below the vaccination rate of 5%/week not long ago.

Footnotes

Valenta, Philip. “Death by COVID-19 Hides in Plain Sight.” HedgeHound (June 29, 2020). The research includes the methodology behind the figures presented here every week, as well as information on historical pneumonia trends and death categorization in the US during the global pandemic. It was last updated on December 4, 2020.