03122021 :: Friday finance

A partial digest:

Friday was day 52 of the Biden-Harris administration. The $1.9 trillion H.R. 1319, the American Rescue Plan Act of 2021, was signed by Biden into law Thursday, after quickly clearing the House again following Senate action last weekend. According to a Tax Policy Center analysis being widely circulated, the lowest quintile of income earners in the nation is set to receive the lion’s share of the package’s after tax income benefits.

This brings us to one of the more significant trading developments from this past week, which is that in spite of stimulus passage, markets reacted weakly on Friday, the first trading day thereafter. The implication could be that people are no longer investing ahead of the curve, or otherwise preemptively spending.

If such behavior persists, we may have finally arrived at the moment where we need real improvements in fundamentals to back it all up, in order for the markets to register any further gains; an actual recovery taking shape, not a pipe dream.

If rising yields are to blame for cooling sentiment, then we're especially stuck for the moment. The Fed would have to exert some yield curve control.

Or, perhaps it will take a giant infrastructure bill, next.

Quick wrap:

US yields climbed further, eclipsing 1.62 on the 10Y.

The DXY held its ground well above 91.

Systemic inflation, as measured by the CPI, remains subdued at 1.7% for the latest revolving 12 month period ending February. The next release of the Fed’s preferred gauge, the PCE, is due out towards the end of March.

Source: “US Economic Briefing: Consumer Price Inflation.” Yardeni Research, Inc. Crypto has been on the move once again, with BTC setting a new all time high above 61k/$USD. Total crypto market cap also set a new ATH north of $1.8 trillion. The stimulus package is expected to drive this even higher. Alt-coin outperformers this past week include HBAR, LUNA, and ENJ.

Source: TradingView Oil fell for the week as OPEC pushed global demand recovery projections out to the second half of 2021, and cut its forecasts for the present. Moreover, the organization does not see 2021 making up for the hit the market took in 2020.

Gold finished higher, but off its high for the week.

Copper, a recovery bellwether, finished the week on a positive note, though it remains down from its one-month high. Consolidation could be in effect. It has already had an amazing run over the last year and is nearing nominal prices that haven’t been seen in a decade.

[tracking: TECK, FCX, TMF/TMV, GLD, JDST, GUSH/DRIP, ETH]Initial jobless claims rose to 712k (SA) for the week ending March 6 from an upwardly revised 754k for the week prior. One year ago, we saw 211k. Note that quite often, the previous week's figures are being upwardly revised.

To add to this, approximately 478k on an unadjusted basis applied for PUA, up from the previous week’s downwardly revised 436k+.

As of February 20, more than 20.1 million people (UA) were still claiming unemployment benefits of some kind, up over 2 million from the week prior. In the comparable week one year ago, the US witnessed more than 2.1 million people claiming unemployment insurance from all programs together.

Almost all UI benefits programs saw increases in continued claims. The PUA program saw the biggest jump of 1+ million, followed by the PEUC at close to 1 million people as they remain unemployed, working their way through the UI system on their way to running out of benefits altogether.1

A reminder that UI eligibility has now been expanded under the Biden-Harris administration. This will involve the retroactive payment of benefits to claimants who were faced with a “devil’s bargain” of returning to work in spite of concerns over safety in the midst of a pandemic, or declining some level of employment—and therefore income—with no recourse.

The expansion falls within the PUA UI benefits program structure, and its administration will be handled at the state level. Claims should be filed with a person’s local benefits office.

Mortgage applications decreased a blended 1.3% (SA) for the week ending March 5, due to decreases of 5% in refis and 7% in homebuyer applications.

The report once again neglected to mention the average loan size across purchase applications. MBA’s choice for a 30Y fixed benchmark came in higher at 3.26%. The simple national average as reported by Freddie Mac (via FRED) for March 11 was 3.05% on the 30Y fixed.

ARM activity increased, signifying the relaxing of borrower standards previously mentioned here to pull more people into the market. Again, not a great development with no dependable foothold for an economic recovery, yet.

At the same time, the forbearance rate fell slightly to 5.20% as some households made their exit in one way or another. Exits, the good, the bad, and the ugly, are expected to pick up now and into next month as we mark a year of being beset by the pandemic in the US.

Of concern is that the percent of households that are current is falling, now above 12% as opposed to closer to 14% at the close of January. Additionally, the relative number of households on extended forbearance grew, while those continuing to make payments in these days of forbearance shrunk.

The expectation here remains that we’re due for housing market—and more generally, real estate—weakness. However, massive infrastructure spending could help matters.

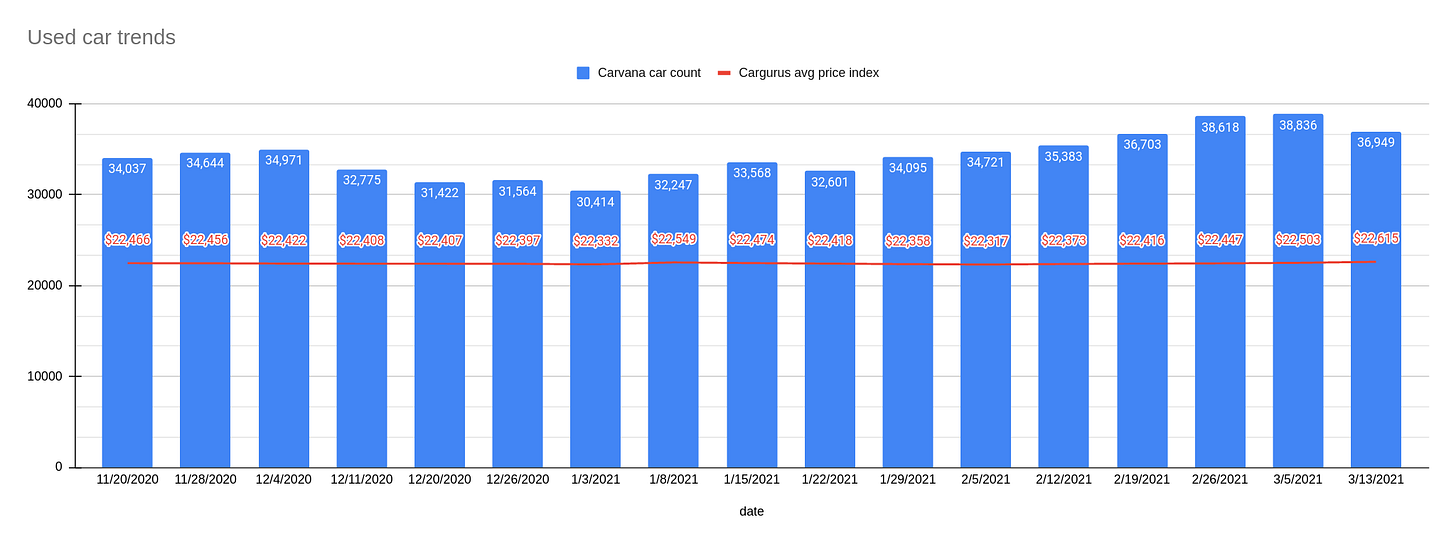

[tracking: NLY, XLRE, DRV, SPG, VNO, WPG]Used car trends: The latest Carvana car count as of March 13 dropped 4.86% to 36,949 vehicles from 38,836 the week prior, marking the first drop in several weeks. Meanwhile, the CarGurus average price index continued rising, this time by 0.50% to $22,615 from $22,503.

Sovereign matters:

S&P Global downgraded Kenya on account of the negative impact of the pandemic upon the nation’s economic growth, as well as rising fiscal deficits. This, in spite of IMF and World Bank assistance.

S&P Global downgraded Montenegro given the major hit its international tourism industry took with the pandemic in full effect, among other things.

Moody’s upgraded Serbia with a stable outlook, thanks in part to a reliance on industries that proved less vulnerable to the pandemic than others, such as agriculture versus tourism. What’s more, the continued implementation of structural reforms played a part in the rating action, as well as a trend of privatization, reasonable fiscal management, lower cost of debt, solid vaccine rollout, and more.

[tracking: EDC/EDZ, VWO, EWU, IEV]

The current state of equity: Tech millions spent on diversity with little to show for it, except for the show of it.

As of the CDC's March update, the US has witnessed 192,575 fatalities strictly classified as “pneumonia” with no acknowledgement of COVID-19 on the death certificates, per excess deaths data. That’s an average of 439 people per day. As the CDC points out, many of these could be miscategorized COVID-19 fatalities going unrecognized in official tallies, meaning we’re undercounting. This, in addition to the official coronavirus death toll of 533,769 puts the probable COVID-19 death figure somewhere north of 630k. Across all causes of death, we suffered 118% of the deaths in 2020 that we would have expected in non-pandemic times given historical trends. Along with other situations where COVID-19 was not designated as a cause of death but where SARS-CoV-2 likely triggered a condition or exacerbated a preexisting one—heart disease, hypertension, diabetes, dementia—the “real” fatality count is probably much higher.2

NPR reports that some 10.3% of the population in the US has been fully vaccinated, up from 8.4% last week.

An increasing vaccination rate notwithstanding, we stand to lose ground we’ve gained on SARS-CoV-2. As location after location drops any precaution-related mandates, the NIH director urges all of us to keep our masks on. Spring break is coming up, after all.

Footnotes

“Unemployment Insurance Weekly Claims News Release.” Release Number: USDL 21-420-NAT. US Department of Labor (March 4, 2021).

Valenta, Philip. “Death by COVID-19 Hides in Plain Sight.” HedgeHound (June 29, 2020). This research includes the full methodology behind the figures, as well as other details regarding death categorization in the US during the global pandemic. It was last updated on December 4, 2020.