03052021 :: Friday finance

A partial digest:

It's day 45 of the Biden-Harris administration.

The $1.9 trillion stimulus package is being put through the paces. Wrangling in the Senate continues, with a vote nigh. As expected, a $15 minimum wage raise didn’t make the cut.

H.R. 1319, the American Rescue Plan Act of 2021, will be passed by Senate Democrats over the objections of Republicans, it’s believed. Then, a variation of it will be sent back to the House for another vote before making it to Biden’s desk. Democrats are working against a March 14 deadline, when existing UI benefits expire.

Members of Congress on both sides of the aisle decry the bill for one reason or another, and for that which it contains as well as that which it does not.

US yields rose yet again, striking 1.60 on the 10Y before easing slightly. Major indices plunged more than once this past week. If that’s what happens when yields are rising, then it would seem that too many have gone out on a debt limb. As recently as the second half of 2018, we had long-term rates over 3%. In prior years, they were more like 5% and above. Yet now, we have genuine panic.

This is not about inflation. Oil is showing its mettle, but because of supply issues/reduced US production as much as any inflation expectations. Stocks are inflationary assets, and yet they’ve been pounded on.

On the other hand, if volatile market action has to do with yields as they impact borrowing costs, the implications may be as follows: credit levels that cannot be sustained, resulting in delinquencies and bankruptcies; economic activity slowing further; questions over who will fund the US government; speculative investing with cheap debt that is getting less cheap and may accordingly need to be unwound.

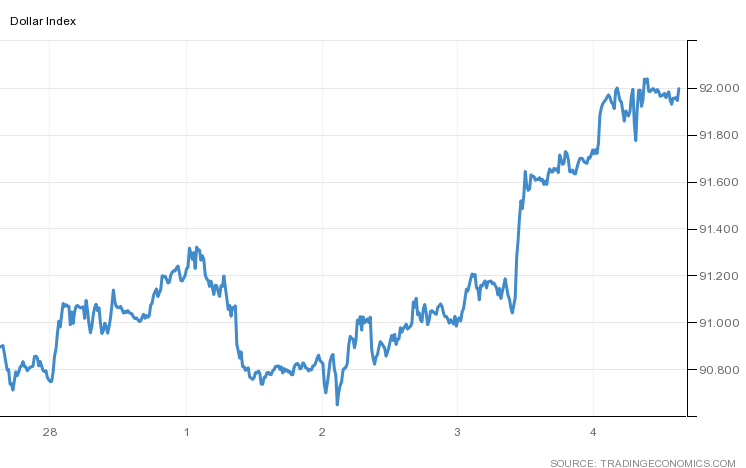

[tracking LQD, HYG, SJB]At the same time, the DXY is gaining rapidly, nearing 92. Dollar bears were sure they were in for some salmon, especially with an incoming stimulus package.

During asset selloffs such as those this past week, it would appear that people are moving to cash; not Treasuries (which is a break with historical tendency), not gold, and not really crypto (though it’s sitting tight).

As people steer clear of US government debt, one has to wonder: Is there a big short in effect?

[tracking: DXY, TMV]Gold fell further, dipping just barely below $1,700/oz. From the one month chart that follows, we can see lower lows being set as the decline appears to pick up steam. The view here is that the decline will persist; $1,200/oz again some day doesn’t seem unreasonable.

[tracking: GDX, GDXJ, DUST, JDST, GLD, SLV]Oil is a phoenix rising (for the time being). As anticipated, contributing to this are reduced production in the US due to supply shocks and (probably) inflation expectations (but not actual systemic inflation). In the near-term, this is not surprising. However, global plans for the future rely on reducing our use of, and dependence on, oil, and momentum is already carrying us in that direction. In the US, for example, another $40 billion in federal financing may be forthcoming for the clean energy industry.

[tracking: XLE, GUSH, DRIP]Initial jobless claims rose to 745k (SA) for the week ending February 27 from an upwardly revised 736k for the week prior. One year ago, we saw 217k.1

To add to this, approximately 437k on an unadjusted basis applied for PUA, up from the previous week’s downwardly revised 427k+.

As of February 13, over 18 million people (UA) were still claiming unemployment benefits of some kind, down slightly over 1 million from the week prior. In the comparable week one year ago, the US witnessed more than 2 million people claiming unemployment insurance from all programs together.

Almost all UI benefits programs saw declines. The exception was the federal employees group, which experienced a slight uptick.2

A reminder that UI eligibility has now been expanded under the Biden-Harris administration. This will involve the retroactive payment of benefits to claimants who were faced with a “devil’s bargain” of returning to work in spite of concerns over safety in the midst of a pandemic, or declining some level of employment—and therefore income—with no recourse.

The expansion falls within the PUA UI benefits program structure, and its administration will be handled at the state level. Claims should be filed with a person’s local benefits office.

Meanwhile, the economy added more jobs than expected, or 379k, and the unemployment rate ticked down to 6.2%. A falling unemployment rate is not terribly significant at this time, as this could be due to job seekers simply giving up, or otherwise not being counted because they don’t fit the parameters of the calculation. Indeed, Yellen called out a real unemployment rate of 10%, “if we really measure it properly.”3

However, the jobs gain is definitely something to take note of.

Mortgage applications increased just 0.5% blended (SA) for the week ending February 26, due to increases of 0.1% in refis and 2% in homebuyer applications.

The average loan size across purchase applications fell, though the MBA report does not indicate to what value. MBA’s choice for a 30Y fixed benchmark came in at 3.23%. The simple national average as reported by Freddie Mac (via FRED) for March 4 was 3.02% on the 30Y fixed.

The expectation here remains that we’re due for housing market—and more generally, real estate—weakness.

Some 2.6 million households are still in a state of mortgage forbearance, and that rate ticked up ever so slightly as of February 21.

We have worked our way through many home and refi customers already as of last year.

Lending standards are being relaxed to pull in more people, but prices and rates are rising, pricing people out, and supply is limited.

Mortgage originator IPOs have reached a point of saturation with would-be investors.

The labor market is in pain.

Some mortgages are delinquent, foreshadowing foreclosures.

With all this, and construction activity humming along as it is, supply could eventually slingshot past demand. Interestingly enough, an “end to the pandemic” could bring about a greater supply of homes, putting downward pressure on prices, as some once again feel free to make decisions that they put on hold given the health crisis.

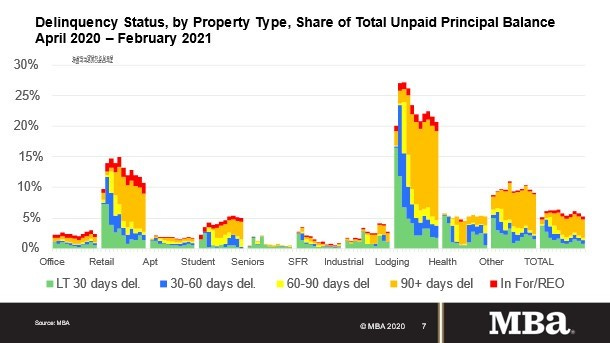

As for commercial property, loan delinquency rates ticked down ever so slightly for the month of February, though lodging and retail derived CMBS are still under duress.

[tracking: NLY, XLRE, DRV, SPG, VNO, WPG]Used car trends: The latest Carvana car count as of March 5 increased 0.56% to 38,836 vehicles from 38,618 the week prior, while the CarGurus average price index rose 0.25% to $22,503 from $22,447. This is the highest car count reported since the start of data gathering for this newsletter in November of last year.

Total vehicles sales, as reported by Autodata, rose for the month of February, mostly driven by new truck sales.

Sovereign matters:

After scrapping growth targets last year, China is targeting a 6%+ GDP growth rate for 2021. This is milder than what others have forecast for the country, including the IMF and its estimate of 8.1%.

Moody’s has downgraded Mauritius on account of the negative impact of the pandemic upon the nation’s economic dependency on international tourism. There will be further ripple effects, according to the ratings agency, with a more thorough recovery not projected until the end of 2022.

[tracking: EDC/EDZ, VWO, EWU, IEV]

The current state of equity: A less than pretty picture of Lloyd’s of London/UK insurance leadership.

As of the CDC's March 5 update, the US has witnessed 189,147 fatalities strictly classified as “pneumonia” with no acknowledgement of COVID-19 on the death certificates, per excess deaths data. That’s an average of 440 people per day. As the CDC points out, many of these could be miscategorized COVID-19 fatalities going unrecognized in official tallies, meaning we’re undercounting. This, in addition to the official coronavirus death toll of 522,360 puts the probable COVID-19 death figure somewhere north of 620k. Across all causes of death, we suffered 118% of the deaths in 2020 that we would have expected in non-pandemic times given historical trends. Along with other situations where COVID-19 was not designated as a cause of death but where SARS-CoV-2 likely triggered a condition or exacerbated a preexisting one—heart disease, hypertension, diabetes, dementia—the “real” fatality count is probably much higher.4

NPR reports that some 8.4% of the population in the US has been fully vaccinated.

Vaccines or no, we may blow our progress against SARS-CoV-2 by throwing caution to the wind, given the presence of variants in particular.

Footnotes

“Unemployment Insurance Weekly Claims News Release.” Release Number: USDL 21-376-NAT. US Department of Labor (March 4, 2021).

PBS NewsHour (@NewsHour). Interview segment with Treasury Secretary Janet Yellen. Twitter (March 5, 2021).

Valenta, Philip. “Death by COVID-19 Hides in Plain Sight.” HedgeHound (June 29, 2020). This research includes the full methodology behind the figures, as well as other details regarding death categorization in the US during the global pandemic. It was last updated on December 4, 2020.